Brian Copeland

By Brian Copeland

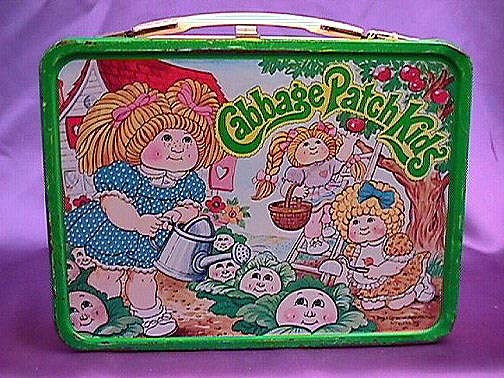

In 1982, I faintly remember my mom going to fight at Kmart for the newest batch of Cabbage Patch dolls. It was a big deal. They were the hottest toy. All the little girls (and some boys) wanted one. It was only a few weeks to Christmas. It was a recipe for opportunity or disaster. She could get in the fight, get the doll and have a happy Christmas for her niece or wait until after Christmas, get a new batch, miss the rush but miss the holiday.

Showing houses to buyers over the past few weeks here in Nashville, I kinda get an idea of how mom felt back in 1982. It seems that every house we walk in priced below a certain price is either (1) in multiple offers, (2) a short sale that can’t make the contract deadline or (3) just contracted.

Showing houses to buyers over the past few weeks here in Nashville, I kinda get an idea of how mom felt back in 1982. It seems that every house we walk in priced below a certain price is either (1) in multiple offers, (2) a short sale that can’t make the contract deadline or (3) just contracted.

So, where does that leave us, the practitioners, and our buyers today? If they wait for a better inventory, they miss the tax credit. If they go to contract now, they may be making rushed decisions. As great buyer’s agents, it’s our job to guide them to the best decisions possible. Here are a few tips I’ve been working out with my current buyers.

- Pre-counseling is mandatory. In the counseling session, it’s imperative to discuss short sales and foreclosures in depth, giving them every scenario possible. Explain to them the “season” of searching they are in and what to expect between now and April 30.

- Be ready to get creative. If you have a short sale contract in the works, it may represent your buyer well to search for other homes and place offers on those homes contingent on the denial/failure to close the other address. You could find yourself within the closure deadline but NOT the contract deadline! Check with your broker about what you can and can’t do, but be ready for deadline scenarios. And by the way, don’t even THINK about backdating contracts. Be ready for buyers to ask you if it’s possible. Be ready as a listing agent to be asked about it. Have a simple script ready for that question, “Uh…no!”

- Keep an open calendar. This is not the time to load up on association meetings, lunch appointments with business colleagues and classes. Those can wait until late Spring. Realize your weekends are gone for a the next few weeks, too. I’ve told all my friends, “I promise, I’ll be back soon.”

- Pick up some affordable listings…fast. Get on the phone, social media and in your sphere and find out who has a home that might appeal to this buyer. Don’t be afraid to take a shorter listing period to give sellers the confidence that you are answering a supply/demand need.

- Don’t let your service and systems lag. It’s easy to think, “Hey, I’m busy,” and ignore your other business practices in this mad dash. Add an extra hour to your work time for a lighter version of your daily lead/touch routine.

We’re going to make it through this wonderful time, just be ready, my YPN people!

Brian Copeland is a real estate practitioner in Nashville, Tenn. You can follow Brian on Twitter: @NashvilleBrian

Comments 6

Very timely Brian, we all need to man-up in times such as these. Those who are doing so are thriving.

Pingback: uberVU - social comments

Pingback: Tweets that mention Cabbage Patch Dolls, 1982 and A Mad Rush : YPN Lounge -- Topsy.com

Great advice, Brian – but are you making a blanket statement that you won’t be able to close a short sale by June 30? Or are you just saying, chances are you won’t be able to close one in time. Wells Fargo tells us that for loans they’re holding in their portfolio (i.e., no investor approval needed), they’re responding to short-sale packages within days.

Brian,

Great advice to share with those working with buyers. Something else to add is that interest rates will go up at some point. Unfortunately we do not have a crystal ball to determine when this will happen, but it is inevitable.

By the way, like the Cabbage Patch analogy. I worked for a toy store during college when Furbies were big. Insanity!

@Nobu, thanks pal. @Stacey (first I love this month’s REALTORMag…great job on Crowdsourcing) the statement is not a blanket statement, thus why I used the phrase “You COULD find yourself.” My history of short sale negotiations (representing buyers) with Wells Fargo has proven to me that my “COULD” should honestly be changed to the word “WILL.” Perhaps currently their statement to you is true for today, however the brand they have proven to us agents in the trenches tells a completely different, inconveniencing story. It’s not a risk I’m willing to avoid articulating to my buyers and the agents I work alongside. Today, I could tell you, “Stacey, I’m not a blogger,” however, my history and the knowledge you have of me tells you differently. Hope to see you in DC in May!!